Mission, Vision and Market View

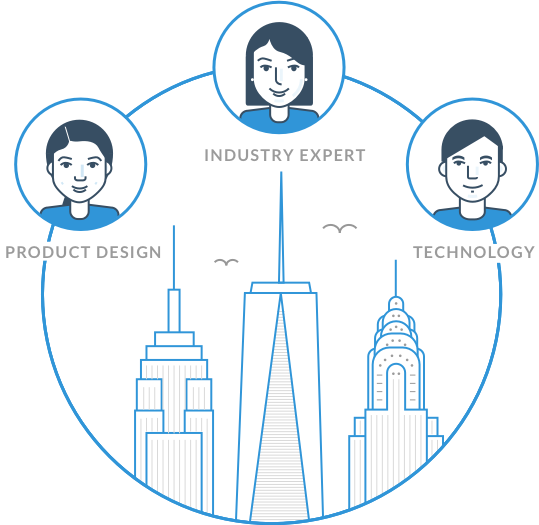

Lendium's mission is to revolutionize the banking industry by providing safe and secure way to borrow, lend and trade credit products.

Marketplace lending continues to grow exponentially by tapping into a multi-trillion-dollar banking industry, while at the same time its regulatory oversight continues to expand. As a result, market participants are in immediate need of transparent, efficient, secure and trust-driven platform to facilitate simple and complex financial transactions. While banking industry is undergoing major transformation, our vision is to become the leading marketplace lending platform for participants ranging from borrowers that need to obtain small personal loans to a large financial institution that wants to arrange a multi-billion dollar syndicated loan.